R347,400.00 Salary Income Tax Calculation and Salary Example R347,400.00 Income Tax Calculations for 2020 YearlyĮmployer Contribution to Retirement Fundsġ Percentage expressed in relation to Gross Income. Below is an example salary after tax deductions based on the 2019 - 2020 tax tables.

#2020 TAX TABLES PLUS#

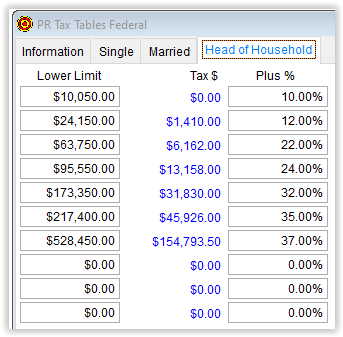

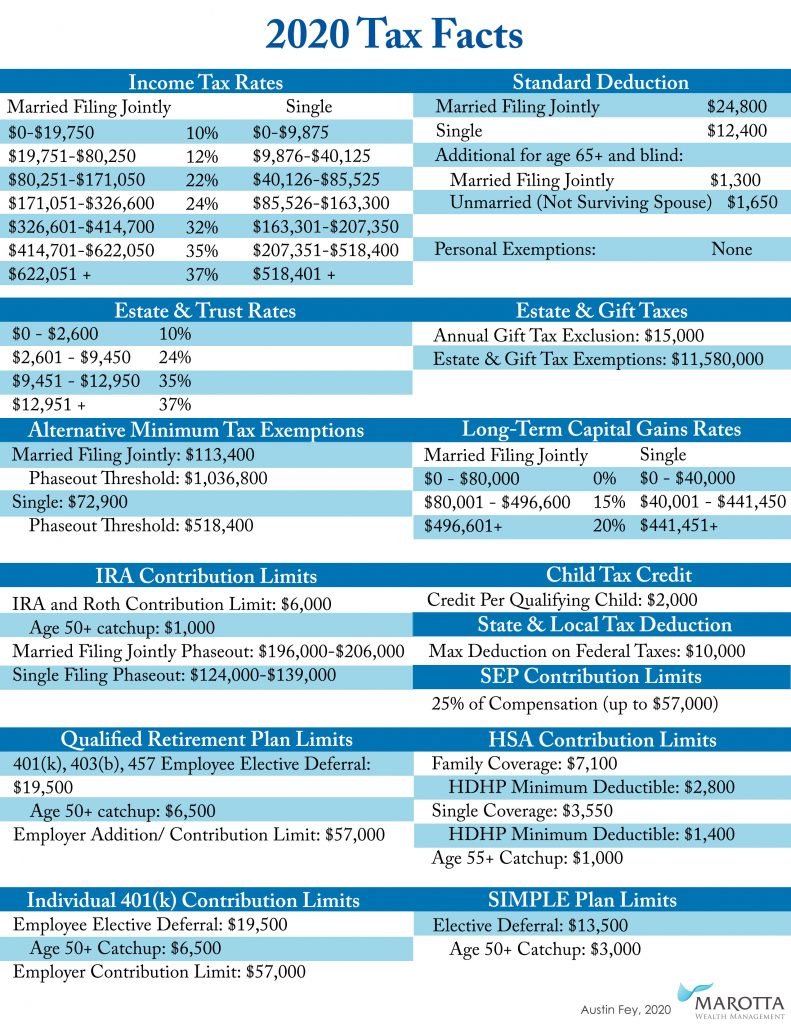

Income Tax Tables are used to calculated individual salaries, apply tax deductions and tax credits to produce a net take home pay (your income after deductions). Tax brackets 2019-2020 18,201 - 37,000, 19c for each 1 over 18,200 37,001 - 90,000, 3,572 plus 32.5c for each 1 over 37,000 90,001 - 180,000.

Retirement & Death Benefits or Severance Benefits South Africa 2020 Tax Tables for Retirement & Death Benefits or Severance Benefits Taxable Income (R) Percentage rate of tax due within the threshold Withdrawal Benefit South Africa 2020 Tax Tables for Withdrawal Benefit Taxable Income (R) Income Tax Rate (Year 2023 onwards) P250,000 and below. The links in the 'Country/Territory' row of the following table link to the article on the GDP or the economy of the respective country or territory. Pension Contributions: Maximum Annual contribution The new income tax rates from year 2023 onwards, as per the TRAIN law, are as follows. The table initially ranks each country or territory with their latest available estimates, and can be reranked by either of the sources. Pension Contributions: Maximum Income contribution Retirement Lump Sum Benefits South Africa 2020 Tax Tables for Retirement Lump Sum Benefits 27.5% Interest Exemptions threshoold for an individual 65 and olderįinal Withholding tax charged on interest from a South African source payable to non-residentsįoreign Dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company)Ĭapital Gains Tax (CGT) South Africa 2020 Tax Tables for Capital Gains Tax (CGT) %Ĭapital Gains Tax for Individuals and Special Trusts It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. Interest Exemptions threshoold for an individual younger than 65 The federal tax brackets are broken down into seven (7) taxable income groups, based on your filing status. Medical Tax, percentage of deductible earning

Medical Tax Credit for each additional dependant(s) Medical Tax Credit for the first dependant To find your tax: Read down the left column until you find the range for your Iowa taxable income from line. Medical Tax Credit for the taxpayer who paid the medical scheme contributions 2020 IA 1040 TAX TABLES For All Filing Statuses. Unearned income is income from sources other than. Note that the figures below show the annual Medical Tax Credit amounts South Africa 2020 Tax Tables for Medical Tax Credit Rates R3,720.00 The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24. The MTC is a fixed monthly amount that increases in line with the number of dependants you claim for. Federal Income Tax Schedules Schedule X: Single Individuals. They are published in Revenue Procedure 2019-44. (For each 1,000 you make after that, you can deduct 10 less of your PMI, up to 109,000.) PMI is. The federal tables below include the values applicable when determining federal taxes for 2020. People with negative income because of losses are recorded as having nil taxable income in the. For people with IR3 tax returns or Personal tax summaries, this is income from all taxable sources less allowable deductions and losses. In addition to these rates, a 3.8% net investment income tax is assessed on the capital gains of high earners, regardless of whether they are long- or short-term in nature.Please note that the Medical Tax Credit is a non-refundable tax credit and cannot be carried over to the next tax year. The upside: It’s tax-deductible as long as your adjusted gross income is less than 100,000. Taxable income for individuals: income on which personal income tax is assessed for the March year. Figures represent taxable income, not just taxable capital gains.

0 kommentar(er)

0 kommentar(er)